Today for a retail bank, client acquisition would be impossible if they do not have an internet banking portal. We believe that investment banking and insurance will follow this trend.

With this in mind we partnered with industry experts and built an all in one financial platform which automates and consolidates all back office operations. We built this system with the Investor at its core. From day one our goal was to make investing simple and safe to Investors.

New module!

New module!

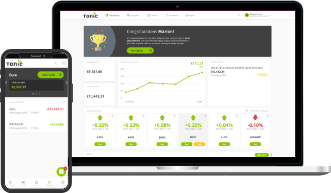

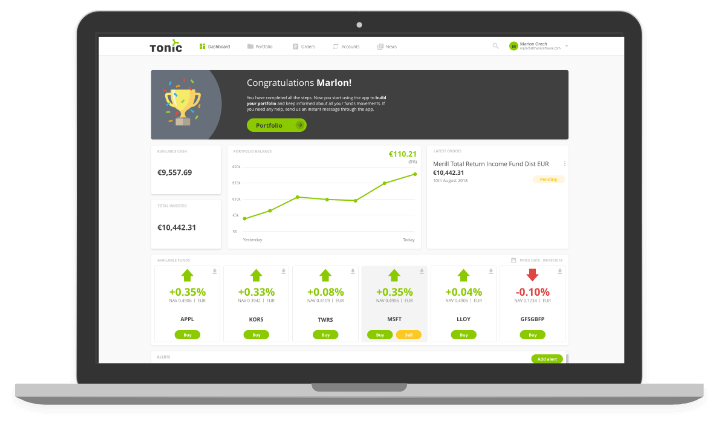

Investor Portal

- Portfolio Management

- Cash Movements and Balances

- Tailored Data Feeds

- Alerts

- GDPR Compliant

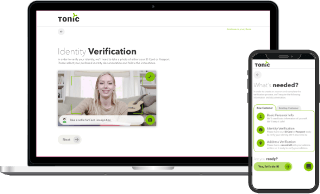

Client Onboarding

- Customizable Offers and Data Entry

- Intelligent Document Scanning

- Face Recognition

- Compliance Video for Verification

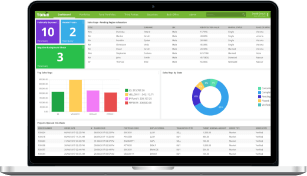

Back Office

- Workflow Management

- Wealth Management

- Portfolio Management

- Fund Administration

- MIFID II Compliant

Need any customizations?

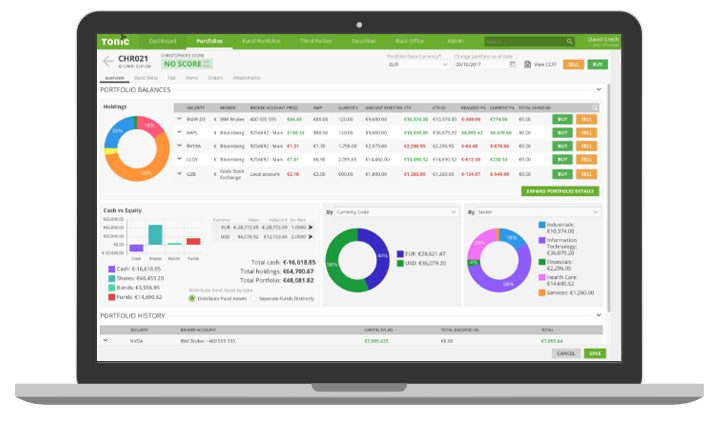

Our Hybrid approach enables us to customize Tonic to your business needs.Investor Portal Omnichannel portfolio management

Full transparency 24/7

- Portfolio P/L NAV and Benchmarking

- Daily Portfolio Movement Report

- Cash Movements, balances and accounts

- Third party news data feeds

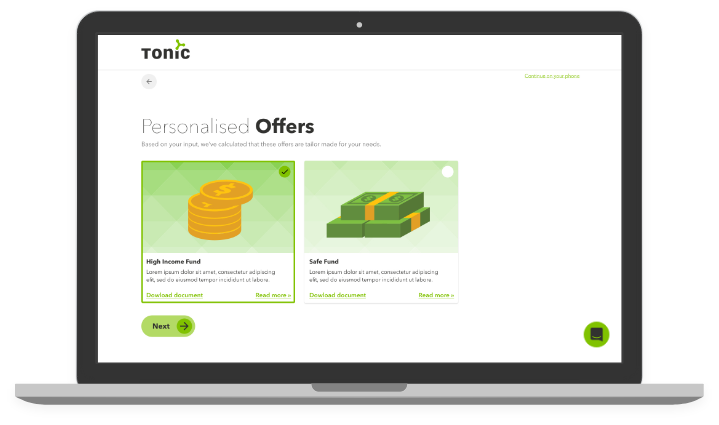

Robo advisory

- AI enabled offer suggestions

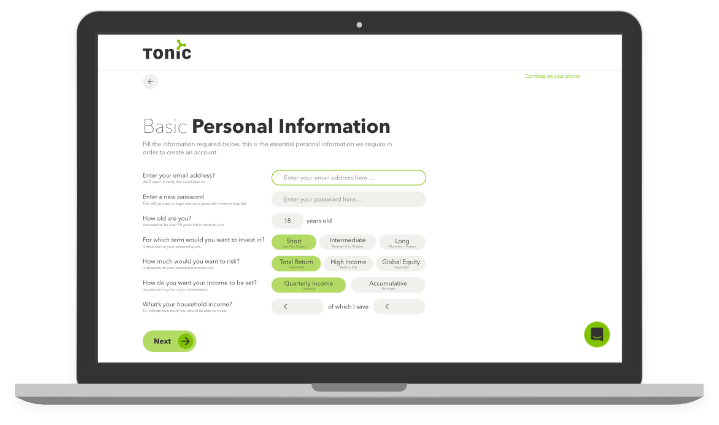

- MiFID II suitability testing

- Relevant news to investors

- Preference, Strategy & Risk Appetite trade propositions

Tailored data feeds

- Market and portfolio position notifications

- Custom reports

- News acticles

- Research articles

Client Onboarding

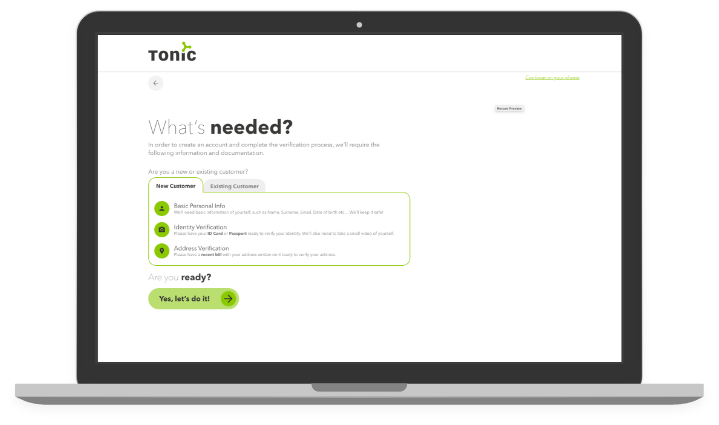

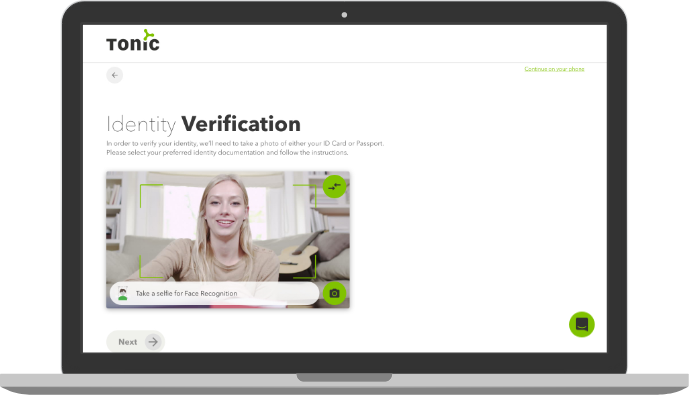

User friendly

- Appealing design. Clean and modern user interface to guide the client through the step by step process.

- Omni channel. Available on desktop, tablet and mobile with the option to switch from one device to another via QR code.

- Help chatbot. A help function throughout the onboarding process.

Customizable data entry

- Details required are configurable according to the business needs.

-

Users can choose 2 styles from form data entry:

- Classic form style: the questions would be displayed similar to classic signup forms.

- Conversation style: the questions would be in a form of a conversation.

Customizable offers

- Offers can be promoted in the form of text/image/video.

- A full document can also be attached to respective offering for clients to download.

- More than one offer can be chosen by a client during the onboarding.

- All text, data entries and offers can be modified by the Tonic backoffice onboarding CMS.

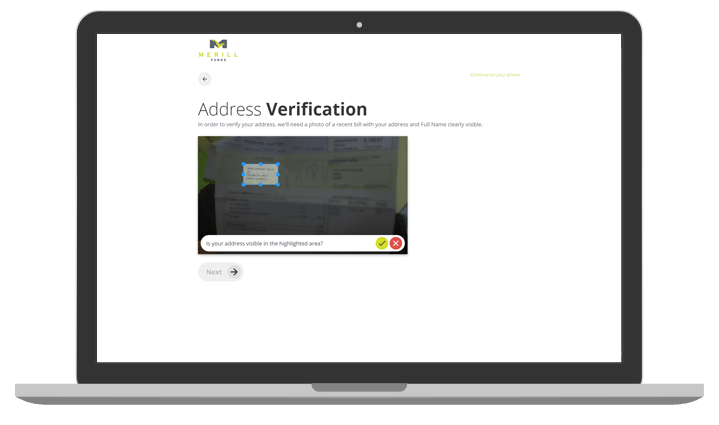

Intelligent document scanning

- Documents and address are scanned and information is automatically extracted for the client to confirm, rather than clients having to manually enter details.

- The list of documents supported for verification purpose is configurable: ID Card, Passport and/or Etihad Credit Bureau.

Face recognition photo / Compliance video for Verification

- The client is asked to take a selfie that is compared with the verification document photo presented.

- A confidence score is then presented in the backoffice for compliance to review.

- A video session of this process is recorded for compliance reasons and is available for compliance to verify.

- Optionally one can configure the onboarding journey to also include a video call with a back office agent for extra verification.

Onboarding Back office

- The complicance officer will have access to the document verification process whereby the video recorded session during the process can be played. The verification process also extracts verification statistics in relation to the face recognition.

- The complicance officer can also review the offering that the client opted for and the advanced information of respective onboarding appliaction.

- A configurable workflow is set for each onboarding type so that each instance goes through the appropiate onboarding flow. This also supports automation to third party systems such as CRM

Back office More than just a PMS

Wealth management oriented CRM

- Smart data entry of individuals, companies and portfolios.

- Compliance workflow to approve accounts.

- Dynamic computed business risk assessment.

- Document expiration triggers .

- Open API which enables you to hook to other CRM systems.

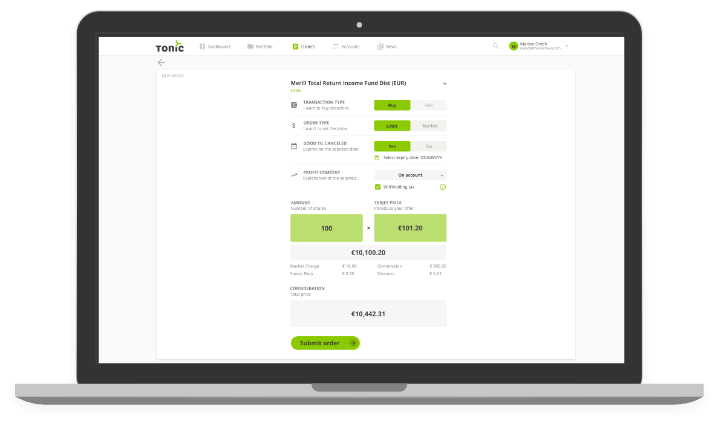

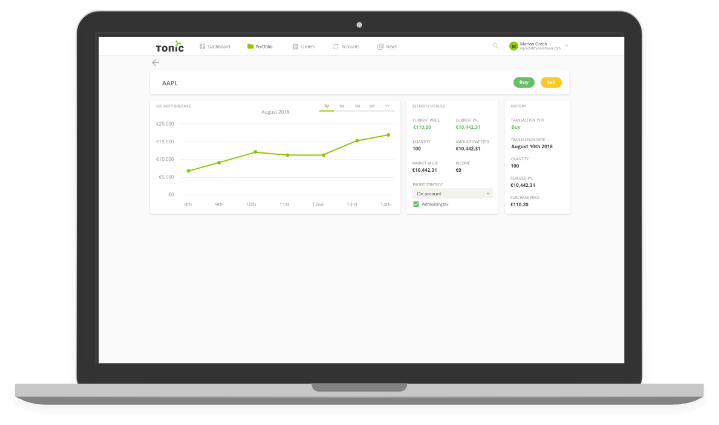

All in one PMS

- Portfolio valuations and NAV Reporting

- Order Management Workflow with complaince at it's core

- Open API which enables you to hook to trading APIs and prices data feeds.

- Corporate action execution and management

- Automated alerts for market changes

- KPIs to deliver insight on portfolio manager performance

- MIFID II transaction reporting

- MIFID II Ex-Ante / Ex-Post reporting

- Management and Reconciliation of Trailer Fees

- Simplified Fee accruals and posting management

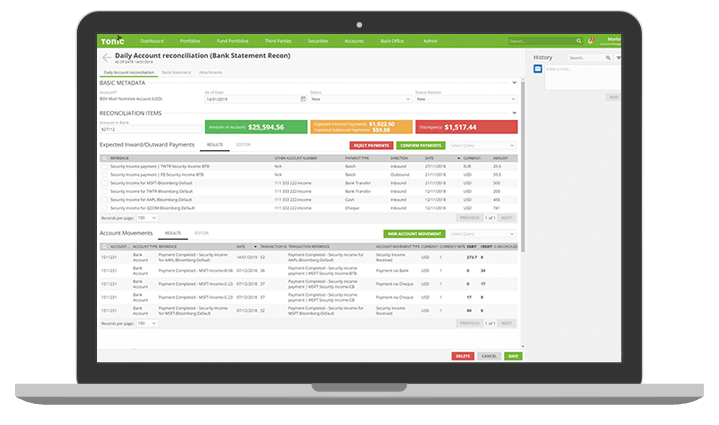

Simplified Cash management

- Configurable accounting rules

- 4-eyes-principle for cash reconcilations

- Bank Reconcilation automation through bank statement upload

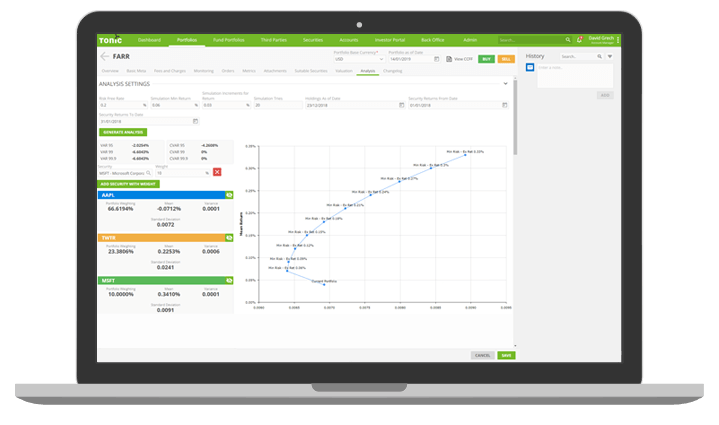

Portfolio analysis

- Efficient frontier generation

- Value at Risk and portfolio ratios

- Composite Benchmarking capabilities

- Simulating new holdings for risk analysis

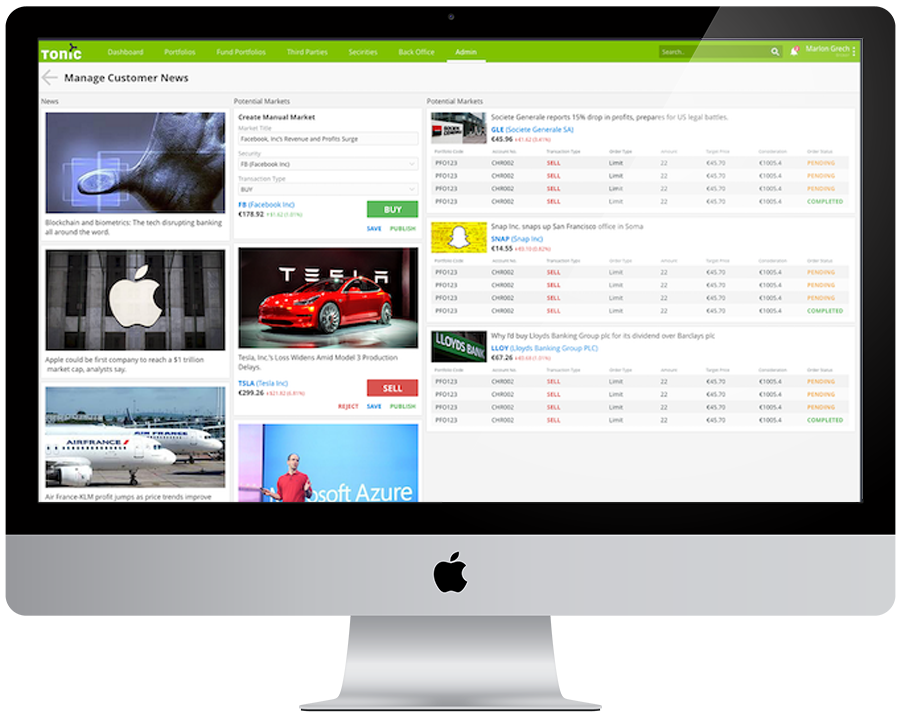

Content Management

- Hook any third party data feed to manage content for your professionals and also your investors.

- Publish research articles to your clients

- Configure actions to be displayed on certain articles

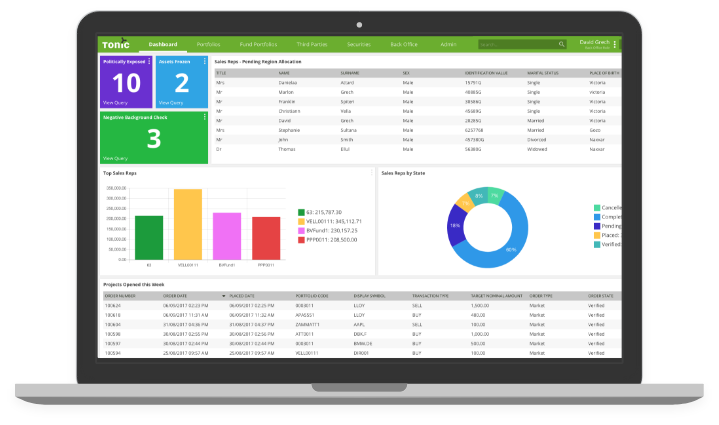

Flexible dashboard

- Users can choose widgets to visually show any data, and set their own queries to configure the source and any filtering criteria.

- The framework supports the development of new widgets as plugins for custom widgets.

- Tonic also supports the concept of global Dashboards, whereby an administrator can configure dashboards and allocate these to one or more roles.

- Configurable alerts on any dataset.

Request a Demo

No binding obligations, no commitments

Thanks for reaching out. We'll get back to you shortly!